Even though you could be in a position to figure out how to obtain a house with no money down, some of the costs may very well be more substantial than anticipated. That’s especially true in case you roll the funding fee into your loan and so rack up curiosity about the funding charge for the lifetime of the loan.

Curiosity fee is as of 7/31/2020. Mortgage loan assumes no costs payable to lender so which the desire fee and APR are the identical. In the event your lender costs any charges in connection with the mortgage loan, your APR will be higher. Assumes a thirty-year fastened price, owner-occupied mortgage loan for a purchaser with a credit rating score of 740+ with a down payment of [Down Payment Percentage] as described while in the Mortgage Calculator.

We will allow the contributions to talk for by themselves, and we won’t be the choose of truth. Booking.com’s purpose is always that of a distributor of suggestions from both guest and property.

The U.S. Office of Agriculture provides a mortgage warranty program for people who decide to acquire in specified rural parts.

Regardless of whether you have a zero down mortgage or whether you save up a down payment of twenty percent — or do something between — carefully contemplate your own condition and produce a selection that’s good for you.

Guaranteed loans are available to “average†cash flow earners, which the USDA defines as All those earning approximately one hundred fifteen% of the world’s median earnings. As an example, a family members of 4 purchasing a house in Calaveras County, California can earn as much as $ninety two,450 a year.

Borrowers in designated rural parts ought to look at themselves Fortunate to obtain access to this very low-cost, zero down loan choice. Anyone searching for a home in a small town, suburban or rural place ought to Make contact with a USDA loan Specialist to determine whether or not they qualify for this good program.

Please don’t involve particular, political, ethical, or spiritual commentary. Promotional information will likely be eradicated and concerns regarding Booking.com’s products and services must be routed to our Customer support or Accommodation Company teams.

Click below to apply for no money down mortgage ohio

This deposit is totally refundable all through Examine-out providing There's been no harm to the house.

The USDA appraisal ought to display the home is in superior issue. It ought to meet community constructing codes and become Secure. Following are a few illustrations:

The USDA loan can be a government-sponsored loan that exists to help produce rural communities by encouraging homeownership. That’s why this loan kind is also referred to as the rural development loan.

If a USDA loan is not an awesome match, You usually have the option of on the lookout into other specialised borrowing goods like FHA loans and VA loans. In the event you’d prefer to see what your likely payment could well be with USDA loans, a get more info mortgage calculator can help.

In case you have your eye over a house by now, you have got an easy task ahead. Simply type the property tackle in the appropriate box about the map. The site will Allow you are aware of if the property is eligible or not. If it’s qualified, you happen to be in luck.

Annual Percentage Rate (APR) calculation is predicated on estimates A part of the table above with borrower-paid finance charges of 0.862% of The bottom loan volume, furthermore origination fees if relevant. If the down payment is fewer than twenty%, mortgage insurance could be demanded, which could enhance the every month payment as well as APR.

But because the USDA loan program is intended for reduced- to medium-money borrowers, your revenue cannot exceed 115% of your respective county's median earnings.

The USDA expenses an upfront charge called the guarantee charge, and this is recognized as a Mortgage Insurance policy Premium (MIP). Presently, this price is 1% of the overall loan amount, and it's rolled into your month to month payments. You may spend this whenever you pay back your loan payment, and it stretches about the existence of your respective loan.

No-down-payment mortgages are an incredible alternative for people who want to obtain, but don’t hold the upfront money, or for those who want to help keep much more hard cash available to avoid remaining house poor.

HOMEstead borrowers must meet the minimal downpayment prerequisite based upon whoever is insuring or guaranteeing the loan.

Our broad choice of mortgage products permits us to offer home loan methods to match your specific wants.

In spite of exactly what the title may well counsel, eligibility is based on spot, not profession. Borrowers searching for a Key home Found within specified rural and suburban locations may very well be eligible for the USDA loan.

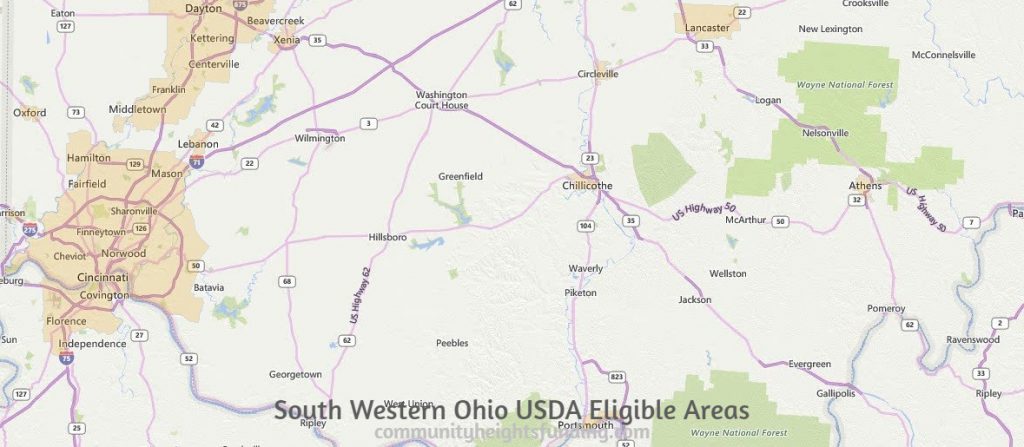

USDA Eligible Map In Ohio Region

Deciding on the ideal lender normally takes a good amount of investigation and needs an intensive evaluate of your personal predicament before you even commence your quest. One example is, If you're a

Mortgage insurance policy is required; nonetheless, It can be in a lessened Value when compared to most traditional loans.

eight techniques for receiving the most out of one's checking account six ways to help you a Center or higher schooler budget How to assist your Center or superior schooler set a personal savings purpose Taxes & Cash flow On this matter

more durable prerequisites from lots of lenders. Maybe possessing uncovered with the economical crisis of 2008, a lot of lenders have tightened their lending requirements.

Since you already know you will find selections for purchasing a home with no down payment, the query stays: can it be a good suggestion?

There won't be any loan boundaries on homes that a USDA loan borrower should buy. As a substitute, the most loan total is based on such individual qualifications as your earnings, debts, assets and credit score background.

Simply how much down payment do you need for any house? How to order a house with $0 down in 2020: 1st time purchaser How to save for your house: The entire information Buying a house without lots of income Down payment items: How to offer and receive a funds down payment present to get a home Earnest money Verify, down payment and shutting costs: When are they thanks?

Geographic Area. The greatest eligibility prerequisite is that the home must be located in a place this program addresses. There are several interactive maps within the USDA Internet site which can pinpoint by condition, county, and precise handle the eligibility.